First, what is it? Asset location planning is the black art of cleverly matching the different asset classes in which your savings are invested to your different savings buckets.

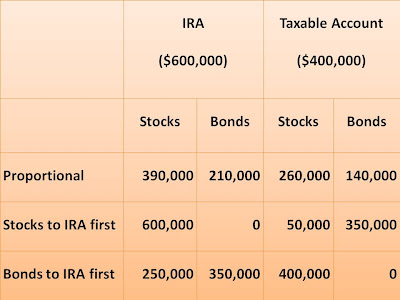

Example. Let’s say you’ve got two savings buckets, an ordinary taxable investment account worth $400,000 and a traditional pre-tax IRA worth $600,000; $1,000,000 in total. Let’s say your investment plan calls for 65% stocks ($650,000) and 35% bonds ($350,000). You can split the two asset classes between your savings buckets in three basic ways (actually, an infinite variety of ways, but three fundamentally different approaches). Which of these asset location plans is the best?

Your asset location plan matters. It matters because returns on stocks are taxed differently from returns on bonds, as I summarized in February 3’s post. So one of those two asset classes is better suited to take advantage of the IRA’s tax exemption. But which one? Stocks or bonds?

Some (most, I would say) favor allocating bonds first to the IRA—the tax-favored bucket—under the theory that all the tax preferences the tax man bestows on stocks are wasted inside an IRA, where everything comes out as high-taxed ordinary income.

Others favor allocating stocks first to the IRA, under the theory that stocks are expected to grow better than bonds over the long run, and can therefore take better advantage of the IRA’s tax exemption. Certainly, inside an IRA you don’t have to worry about the tax cost of selling stocks and incurring a capital gain (you’re inside a tax shelter of sorts), which should make you a smarter investor. (For the four of you who still have gains left after last year.)

My own favorite approach is sort of a hybrid of the two: Favor stocks in the IRA when you’re younger and you have a greater number of years of tax deferral ahead of you, which can better benefit from the greater expected returns of stocks. Then switch strategies when you’re older, and favor bonds in the IRA, when the benefit of lower tax rates on stock returns becomes the overwhelming factor. Here’s an article describing the process:

http://www.cfapubs.org/doi/abs/10.2469/cp.v2005.n5.3512

So when do you make the switch; what’s the crossover point? That very much depends on factors unique to you. In my studies, I have found the late 50’s or early 60’s to be about right. There’s no way to come up with one age that’s right for everybody. And the crossover age is likely later for Roth IRAs than it is for traditional IRAs.

Man, it’s complicated! But clever asset location planning, like clever spigot planning, can add a bit to your long-term retirement spending. So, hey, why not?

No comments:

Post a Comment