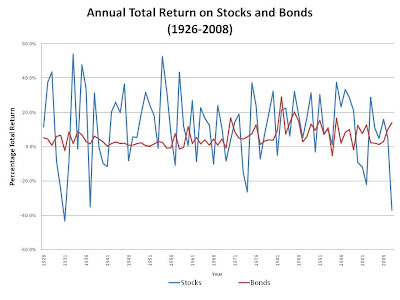

An asset’s “volatility” is a measure of how much it tends to fluctuate in value. Stocks are much more volatile than bonds, as can be seen from the graph below. And that is to be expected given the greater degree of certainty in the promised returns inherent in bonds, and the greater degree of uncertainty companies face in their striving to earn profits in a competitive environment. You might think of volatility as one of the prices you pay for stocks’ higher historical returns.

A couple of points about volatility. First, stocks are very volatile—even turbulent. So you must be prepared, both financially and psychologically, to experience large drops in value before investing a significant part of your retirement funds in them. History has shown that swings in the stock market far exceed what would be expected if the market exhibited the same kind of tame randomness generated by the flip of a coin or the roll of the dice.

Second, volatility comes from the market itself—millions of investors making buy and sell decisions every day, spurred by their individual financial needs, their diverse opinions, their financial gamesmanship, and their psychology. To be sure, fundamental forces such as the state of the economy, the health of the issuer or its business sector, inflation, and the like, play an important role in determining whether a stock or a bond will go up or down. But these fundamentals are only half the story. The combined effect of millions of investors buying and selling creates its own turbulence, adding to the ups and downs of prices. This makes it impossible to consistently predict the direction of a market—any market—stocks, interest rates, real estate, oil, etc.—no matter how carefully you analyze the fundamentals affecting that market. Turbulence is an inherent characteristic of every market.

So, how much volatility can you afford as you strive for the superior average returns of stocks over bonds? More on that in future posts.

No comments:

Post a Comment